The man behind Salad Money has a colourful past

At the same time, he and his wife Agnes own Salad Money, itself a high cost lender (note, not a “high cost short term credit” (‘HCSTC’) company as per the FCA’s definition), aimed at struggling NHS workers.

The FCA has a definition for “high-cost short-term credit” which involves lending to be mostly repaid within 12 months and with an APR of 100% or more.

Until he started Salad Money in 2017, Campbell, who is Scottish and aged 59, had no experience in the sector. His earlier career consisted of financial engineering roles in car leasing and property during which he was connected to some of the country’s most ‘colourful’ entrepreneurs.[1]

It was about these relationships that he gave evidence in a recent case in the High Court of Justice involving the Serious Fraud Office and a twice convicted fraudster called Dr Gerald Smith. The resultant judgement in May last year called into question the reliability of Campbell’s testimony, while it was also revealed that (according to the judge) he was paid to give evidence, and that he had previously worked closely with Dr Smith.

Debt Hacker remains Alan Campbell’s window front. The raison d’etre of this not-for-profit organisation is to fight for the rights of consumers (particularly NHS workers[2]) who have been mis-sold financial products by payday lenders, and also to criticise the FCA’s attempts to regulate the sector. According to its website, it gives “honest information and a free, easy-to-use complaint letter, Debt Hacker helps people get refunds for loans that should never have been issued in the first place. It’s time for the high-cost lenders to pay back the costs of unfair debts and change their ways.”[3] It shows individuals how they can approach the Financial Services Ombudsman to hear complaints. It does not charge a fee for its advice, nor does Debt Hacker or Mr Campbell obtain any benefit from assisting consumers in progressing complaints with the Financial Ombudsman Service relating to irresponsible lending by high-cost lenders trapping borrowers in a cycle of unsustainable debt.

Debt Hacker overlaps not so comfortably with another hat worn by Mr Campbell, namely as the founder and ultimate owner (with his wife) of Salad Finance, itself a high interest lender which trades as Salad Money.[4] This lends money to public service employees at an APR of 69%, which Campbell says is the lowest rate charged by “responsible finance lenders where there is a direct relationship with the consumer market.”

Salad Money focuses on lending to NHS workers, with Mr Campbell claiming that it does not use credit rating data but only ‘open banking’ data which allows it to reach individuals who would normally be barred from obtaining loans: “‘Salad is proving we can lend to people turned down by [the] credit industry… we lend successfully. That’s why we get the support of banks.”

The banks in question include Isle of Man-based Conister Bank, Hitachi Capital (UK) Plc (subsequently renamed Nobuna) and Shawbrook Bank. In August last year, Fair4All Finance, a UK government-backed scheme to financially support the most vulnerable, announced it had agreed to invest £5m over five years into Salad.

Banking insiders, however, describe Mr Campbell as a hard campaigner who can appear “self-serving”. “He is outside the spectrum of the large banking companies,” said one executive from a lending company.

“IMPORTANT NOTICE” A member has been in touch to say they have had contact from ‘Salad Money’. Salad Money said they were affiliated with NHS Credit Union and asked for personal details from our member. We are unequivocally not affiliated with this company who are showing scam type behaviour. Please be cautious.”[5]

In August they followed this up by posting:

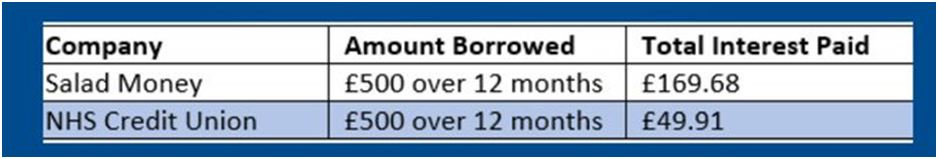

“Please be aware of high interest lenders trying to reel you in!

“This comparison shows the difference between YOUR NHS Credit Union and a company advertising ‘fair affordable lending’ for NHS employees. ?”[6]

Salad Money has also been publicly accused of mimicking the NHS logo on its communications to potential borrowers in order to enhance its credentials. Cat Hobbs, director of public ownership group ‘We Own It’, told one source: “It’s reprehensible that at a time when we’re more reliant on the hard work of our fantastic NHS staff than ever, a loan company is seeking to mimic NHS branding and rip them off.”

Hobbs added: “Once again, rather than supporting the national effort and rallying round our NHS, a private company is looking to make a quick buck. Salad Money shouldn’t be allowed to get away with this and now they’ve been exposed, NHS employees won’t be falling for their tricks.” [7]

Brian Fisher, Socialist Health Association National Chair, and Jean Hardiman Smith, SHA National Secretary, have been quoted as saying, “Salad Money have stated they have a relationship with NHS trusts…We feel this is inappropriate, and would not want to see the NHS supporting such loans. We support credit unions”. [8]

Salad Money does have a confirmed relationship with Mersey Care NHS Foundation Trust, to whom it offers workers a reduced APR of 34.9%.

Mr Campbell says he has admiration for the work of credit unions but he claims that they would not lend to Salad Money’s customers. “It’s rash what they are saying because, frankly, we are not in competition with the credit union, we are not trying to take their customer base, we are not trying to undermine their business. The components of the customer base that we are serving are the underserved.” On the Twitter accusations, Mr Campbell said this was down to a ‘misunderstanding’. Attempts to contact NHS Credit Union were unsuccessful.

Given the pride that Mr Campbell has in FCA-regulated Salad Finance and its activities, it is notable that he is absent from its list of directors and the company’s FCA-regulated officers. Mr Campbell makes no secret of the fact that he is not approved by the Financial Conduct Authority and this is a requirement for directors of regulated lenders.

Mr Campbell maintains that Salad Finance is run by an independent board of directors and has a Public Responsibility and Oversight Board, which it does. He says that the FCA was and is aware of this structure and remains satisfied that it has appropriate ownership and executive and non-executive directors. It is understood that Mr Campbell’s position is that he is only an indirect equity shareholder in the company.

At the same time, archived versions of Salad Money’s website dating to April last year, state that the high interest lender was the “brainchild of Alan Campbell”[9] and that he invested £8 million of his own money into it. A search of Google also shows Mr Campbell to regularly publicly speak on behalf of Salad Money.

Explaining his decision not to be a director of Salad Finance, Mr Campbell says that his temperament does not suit sitting on boards, he claims. “I’m not very good at that, to be honest, it’s not my area of expertise and I don’t have the attention to detail. I’m not someone who is going to sit in a board meeting, it’s just not something that I’m good at.”

He is, however, a director of Salad Finance’s parent company Salad Projects, and also of its parent in turn, Alfie Holdings Ltd. He was also a director of numerous successful companies in the early 2000s, including Seafield Logistics Limited, Global Marine Holdings Limited, Global Marine Systems Limited and Bridgehouse Capital Operations, back when he was working for and with Mr Andrew Ruhan, a property tycoon.

Mr Campbell’s evidence in past court cases has been questioned by judges and professionals, while the cases themselves raise some uncomfortable questions about his past associations.

In a highly contentious divorce case between Tania-Jane Richardson Ruhan and Andrew Ruhan, which took place in the High Court, the latter tried to claim insolvency in an effort to frustrate his ex-wife’s claims. The judge took a dim view, believing instead that Mr Ruhan was using nominees to obscure his assets. Mr Campbell was named in divorce documents as serving in one transaction as a nominee for Ruhan,[10] albeit Justice Nicholas Mostyn did not implicate him in any wrong-doing.

The proceedings revealed that in early 2003, Mr Campbell and Mr Ruhan had negotiated with Dr Gerald Smith over the acquisition from him of 37 hotels (32 under the Thistle brand) and a 29.9% stake in an IT company called Izodia Plc. Collectively known as the “Orb Assets”, the price paid was reportedly around £700 million.[11]

Dr Smith was already of dubious repute by 2003. He had a fraud conviction for stealing £2m from a pension fund in 1996. He was also being investigated at the time by the Serious Fraud Office for defrauding Izodia Plc, of which Dr Smith had been CEO, for approximately £35 million.[12] In April 2006, Smith pled guilty to 10 counts of theft and one of false accounting over the Izodia fraud. He was handed an 8 year jail sentence, and the next year ordered to pay over £40 million. This was the largest award to be made in criminal proceedings at the time. [13] This debt remains unpaid and now stands at £72m taking into account interest incurred.

Dr Smith was released in 2012. He then acted on behalf of Orb a.r.l (his 2002 Jersey property company[14]) to launch proceedings against Mr Ruhan and others, alleging that there had been a separate verbal agreement in 2003 under which Mr Ruhan would develop and sell most of the property assets, paying out between 40-50% of the profits to Orb and two other claimants. Mr Ruhan denied the claim in its entirety.

The dispute widened, spawning multiple different court cases in the High Court, always with Dr Smith and Mr Ruhan at the centre.

Last year, the High Court heard a case brought by the Serious Fraud Office and other interested parties[15] seeking to seize Smith’s realisable assets. On 18 May, Justice Foxton upheld the SFO’s claims.[16] His judgement contained this observation: “Neither Dr Smith nor Mr Ruhan are individuals who were straightforward in their business dealings which gave rise to this litigation, nor indeed were many of those associated with them. Many of the relevant transactions were undertaken either with a view to obscuring their true nature, or negating the apparent effect of other transactions. The result has been a dispute of labyrinthine complexity, in which matters are rarely what they appear to be, and which has offered a near-infinite possibility for disputation.”[17]

Specifically on Mr Campbell, Justice Foxton stated he “is someone who has played various parts in the Smith-Ruhan saga: initially a business associate of Mr Ruhan, who, following a falling out with him threw in his lot with Dr Smith… before falling out with Smith.”[18] He went on to rule that Campbell’s evidence should be regarded with some scepticism:

“Mr Campbell is clearly a witness about whose reliability legitimate concerns are held. I have already referred to the various volte faces in Mr Campbell’s allegiances as the contemporary events unfolded. Ms Aird-Brown [a licensed insolvency practitioner and certified fraud examiner[19]] gave evidence (which I accept) that she was “very wary of Mr Campbell”. Mr Upson [a solicitor], who had also had dealings with Mr Campbell, said he came to have serious doubts about what Mr Campbell had told him, that at one point Mr Campbell appeared to offer his services as a witness in the Orb Claimants-Ruhan litigation dependent on who sees me right, and that when Mr Campbell became frustrated that he had not benefited from [previous] proceedings in 2014 he suggested his recollection of the evidence might have changed.”[20]

The judge went on, “Cook J (a judge in one of the previous cases) had suggested that ‘Mr Campbell’s evidence was “open to question”[21] and it became apparent in a freezing order application… that Mr Campbell had entered into an agreement to be paid for his evidence.”[22] How much is not mentioned.

Justice Foxton surmised: “Against that background, it is easy to see why HPII [a claimant in a previous case] may have felt unable to put forward Mr Campbell as a witness of truth.”[23]

Campbell told the author, “I was brought in as a witness to that court case and I gave what I believed to be a truthful account of events and that’s obviously in the witness statement that they put before the court”.

He continued, “I was asked to give my account of what happened, and I gave my account of what happened. I obtained legal advice independent to the parties, and that’s what happened. I was asked to give my account and I gave my account, and my account is in the court documents now.

“[This was] very complex litigation and my witness statement was pretty central to the case, because I said there was a verbal agreement between Gerald and Andy, which I was a witness to”.

What Mr Campbell neglects to mention but which Justice Foxton’s ruling makes clear is that in 2013 and 2014, Mr Campbell was working closely with Dr Smith in his action against Mr Ruhan.[24]

The judgement referred to, “a series of emails involving Mr Campbell, Mr Ruhan and Dr Smith in January 2013. The first is an email of 9 January 2013 from Mr Campbell to Mr Ruhan (which was clearly sent in co-ordination with Dr Smith)…”[25]

At another point, it stated: “After Mr Ruhan had served further Information denying any interest in the Arena Settlement (a settlement reached by Ruhan’s nominees Messrs Cooper and McNally, secretly on Mr Ruhan’s behalf in 2004[26]), Dr Smith sent a copy of the response to Mr Campbell on 3 December 2013, and made his own views clear, describing the response as “utter bollocks”.”[27]

Shortly thereafter, the judge wrote, “In text messages exchanged between Dr Smith and Mr Campbell between 5 and 13 December 2013, Dr Smith said the IOM Settlement would mean “we trace all and toss [Mr Ruhan] to the wolves”.”[28] In the IOM Settlement, eventually signed in March 2014, Ruhan’s nominees Cooper and McNally, were induced – in the words of the judge – in ‘fraudulent breach of trust’ and without Mr Ruhan’s knowledge,[29] to transfer multi-million pound assets of Ruhan’s which had laid in the Arena Settlement.[30] The assets went to a company owned by Dr Smith’s wife, Dr Cochrane, who was acting on behalf of the Orb Claimants[31]. Dr Smith was found to be the architect of this transfer, but with Mr Campbell clearly involved.

The judge’s comments raise uncomfortable questions for those who have invested into Salad Money and indeed the regulator of a lender focussed on hard-pressed NHS workers.

The author would like to point out that he has received correspondence from lawyers acting for Mr Campbell and Debt Hacker, following publication of this article.

The author offered Mr Campbell and Debt Hacker the chance to respond to this article, which they did through their lawyers. This included the following relevant points:

“Salad Money is not a “payday lender”. The Financial Ombudsman’s Service and StepChange (one of the UK’s leading debt charities) consider “payday lending” to be synonymous with short term, high interest lending. The Financial Conduct Authority publishes a definition of “High Cost Short Term Credit” which involves (i) lending due to be repaid or substantially repaid within 12 months; and (ii) lending which is not secured lending, home credit or an overdraft; and (iii) lending with an APR of 100% or more. Salad Money lends at an APR of 69.9%. This is comparable with interest rates applied by well-known credit card companies (e.g. Vanquis and Marbles). In fact, where an NHS Trust sponsors Salad Money (as with Mersey Care NHS Foundation Trust), Salad Money is able to offer an APR of 34.9%. Further, Salad Money’s loans are for between 12 and 18 months.

Neither Alan Campbell nor Debt Hacker has any management control over Salad Money. Mr Campbell is, with his wife, the indirect owner of the shares in Salad Money, but he does not sit on the executive board of the company and does not exercise any executive management of Salad Money (which is the trading name of Salad Finance Limited). Salad Finance’s board is clearly set out on Salad Money’s website. It contains senior and experienced people. The FCA was aware of the ownership and management structure of Salad Money and approved it. Salad Money is under a regulatory obligation to provide any updates about those issues to the FCA. There is explicit mention on the Debt Hacker website to Mr Campbell’s role as founder of Salad Money – this is not something he is trying to hide.

Salad Money’s issue with the NHS Credit Unions in July 2021. In and around October 2021, Salad Money emailed Mr Kochan about this historic issue. In short, there was a technical problem with Salad Money’s Google Ads settings and key word searches. Salad Money apologised and rectified the problem.

[1] Para 2, page 10 of SFO v LCL

[2] https://debthacker.co.uk/nhs-campaign

[3] https://debthacker.co.uk/who-we-are

[4] https://register.fca.org.uk/s/firm?id=0010X000044DpZBQA0

[5] https://twitter.com/NHSCreditUnion/status/1405461950159634432

[6] https://twitter.com/NHSCreditUnion/status/1427971133199077381?cxt=HHwWisC-_cGLltEnAAAA

[7] https://leftfootforward.org/2020/05/exclusive-loan-firm-accused-of-profiting-off-nhs-brand/

[8] https://leftfootforward.org/2020/05/exclusive-loan-firm-accused-of-profiting-off-nhs-brand/

[9] http://web.archive.org/web/20210118124946/https://saladmoney.co.uk/home/ourstory

[10] See Glossary, under The Orb claim / Headstay Agreement, Richardson-Ruhan v Ruhan [2017] EWHC 2739, where it states, “A call option agreement dated 29 May 2003 between Headstay Limited and Alan Campbell as the husband’s nominee intended to provide some protection for Orb in respect of a share of the profits of the hotel profits only.”

[11] https://www.thelawyer.com/issues/9-june-2003/campbell-and-ruhan-choose-wragges-for-thistle-purchase/

[12] Para 2, SFO v LCL May 2021

[13] https://register.fca.org.uk/s/firm?id=0010X000044DpZBQA0

[14] Para 8.ii, SFO v LCL May 2021

[15] https://files.essexcourt.com/wp-content/uploads/2021/10/25135737/SFO-Anr-v-Litigation-Capital-Limited-46-Ors-In-re-Gerald-Martin-Smith-2021-EWHC-1272-Comm-Trial-Judgment.pdf

[16] https://www.sfo.gov.uk/cases/izodia-plc-gerald-smith/ . See para 593 onwards, SFO v LCL May 2021

[17] Para 3, SFO v LCL May 2021

[18] Para 21, SFO v LCL May 2021

[19] Added by author

[20] Para 49.i, SFO v LCL May 2021

[21] https://files.essexcourt.com/wp-content/uploads/2021/10/25135737/SFO-Anr-v-Litigation-Capital-Limited-46-Ors-In-re-Gerald-Martin-Smith-2021-EWHC-1272-Comm-Trial-Judgment.pdf

[22] Para 49.i, SFO v LCL May 2021

[23] Para 49.ii, SFO v LCL May 2021

[24] For example Para 74,85, SFO v LCL May 2021

[25] Para 434, SFO v LCL May 2021

[26] Paras 58,59, SFO v LCL May 2021

[27] Para 214, SFO v LCL May 2021

[28] Para 80, SFO v LCL May 2021

[29] Para 208, 209, SFO v LCL May 2021

[30] Para 86, SFO v LCL May 2021

[31] Para 1.i, 32, 169, SFO v LCL May 2021